ADVERTISEMENT

Bezel, an online watch trading platform, reports that it has rejected 27% of the watches it has inspected so far this year as part of its authentication service. The majority of the timepieces that failed the authentication tests were Rolex or claimed to be Rolex watches, the Los Angeles-based company says in a report, highlighting its activities in the first six months of 2025. The high rejection rate, with more than a quarter of the watches transacted on the platform not meeting the standards, indicates that so-called 'Frankenwatches' —watches with non-authentic parts, incorrect components, or outright counterfeits or fraud — remain a significant issue for the secondary watch market.

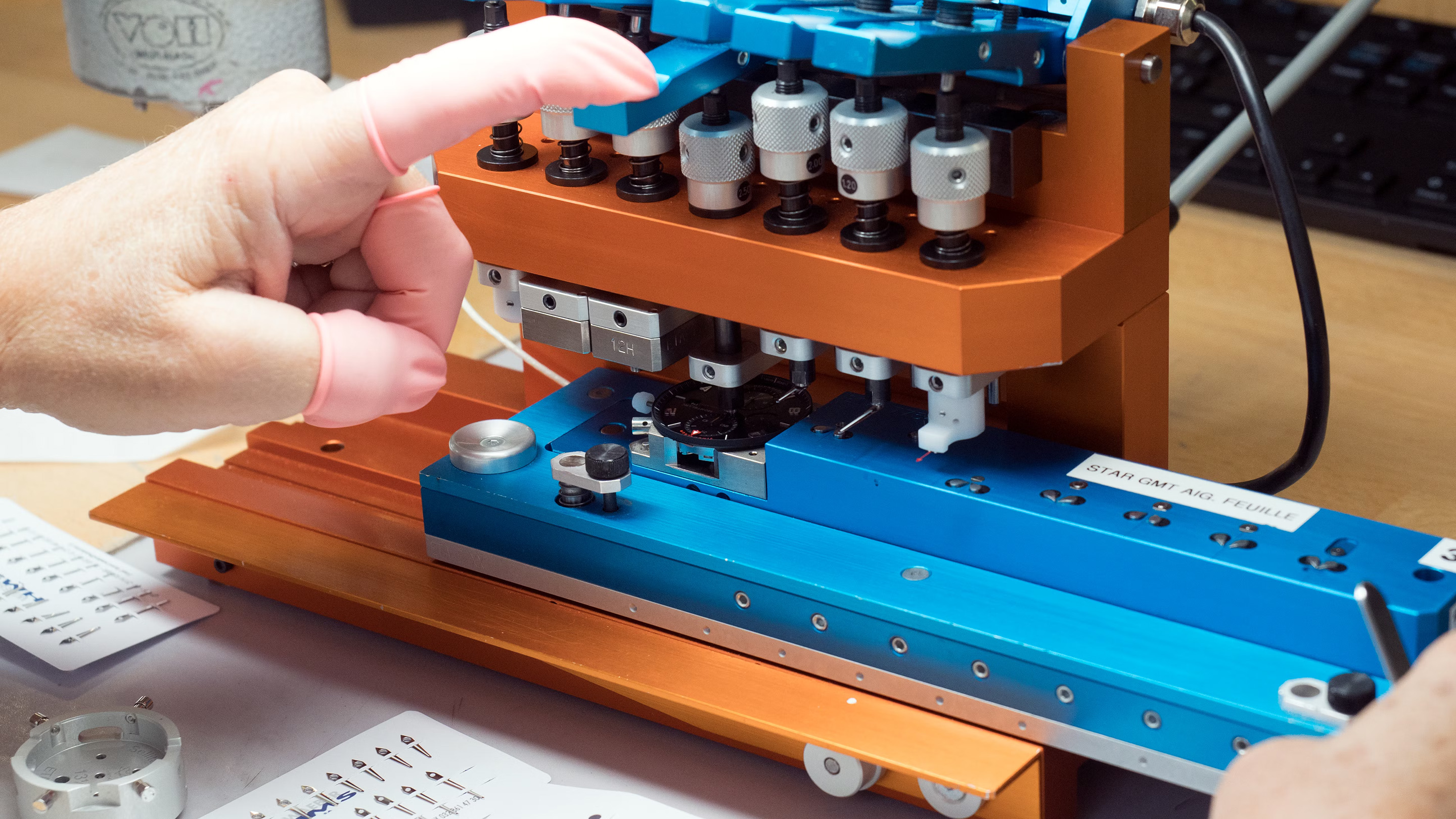

Authentication has become a key element of differentiation for secondary market trading platforms as competitors try and distinguish themselves from traditional used watch dealers. Major trading platforms, including Bezel, eBay, and Chrono24, all offer authentication services for used watches in exchange for fees. They also compete with Rolex's Certified Pre-Owned program, run by Rolex Authorized Dealers, which charges buyers a premium for watches officially certified by the top Swiss brand. In the report, Bezel states that it also rejected watches whose condition failed to meet the description in their listing or weren't operating properly. "Watches that fail our authentication often lack correct descriptions in the original listing. In-hand, watches may not match their aesthetic condition, or they may not include crucial descriptions of elements that affect the value and desirability of the watch, such as swapped components and parts,'' Ryan Chong, Bezel's Chief Marketplace Officer, says in the report.

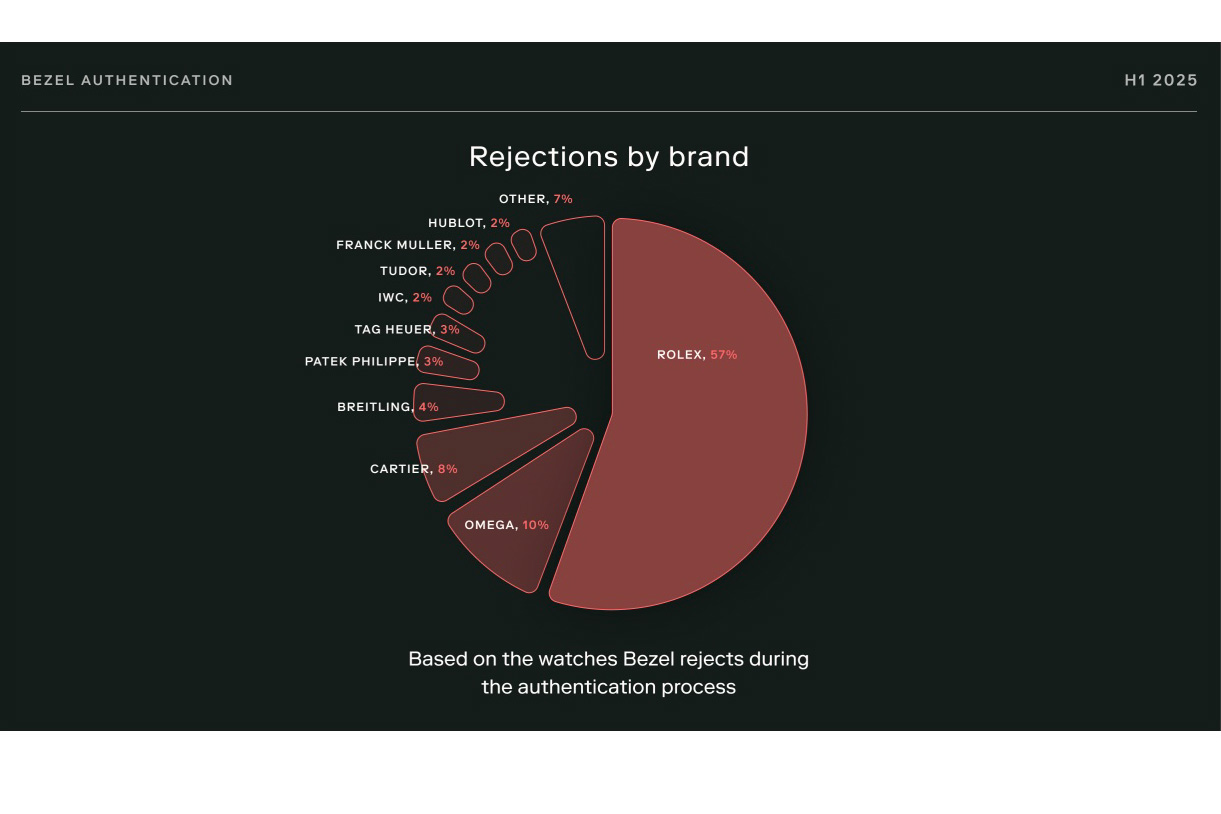

Of the rejected watches, 38% were listed at prices above $10,000. By brand, Rolex accounted for more than half of the rejections at 57%, as it continued to lead the category, "due to its high market demand and counterfeiting incentive," Bezel says in the report. Omega experienced a steady increase in rejections and took second place, with a 10% share. Cartier was next, accounting for 8%, followed by Breitling at 4%, and Patek Philippe at 3%, rounding out the top five. Bezel says the rejections by brand statistics ''closely follow the hierarchy of top watchmakers in today's market, reflecting a rational correlation between market demand and incentive for counterfeiting and deceptive practices.''

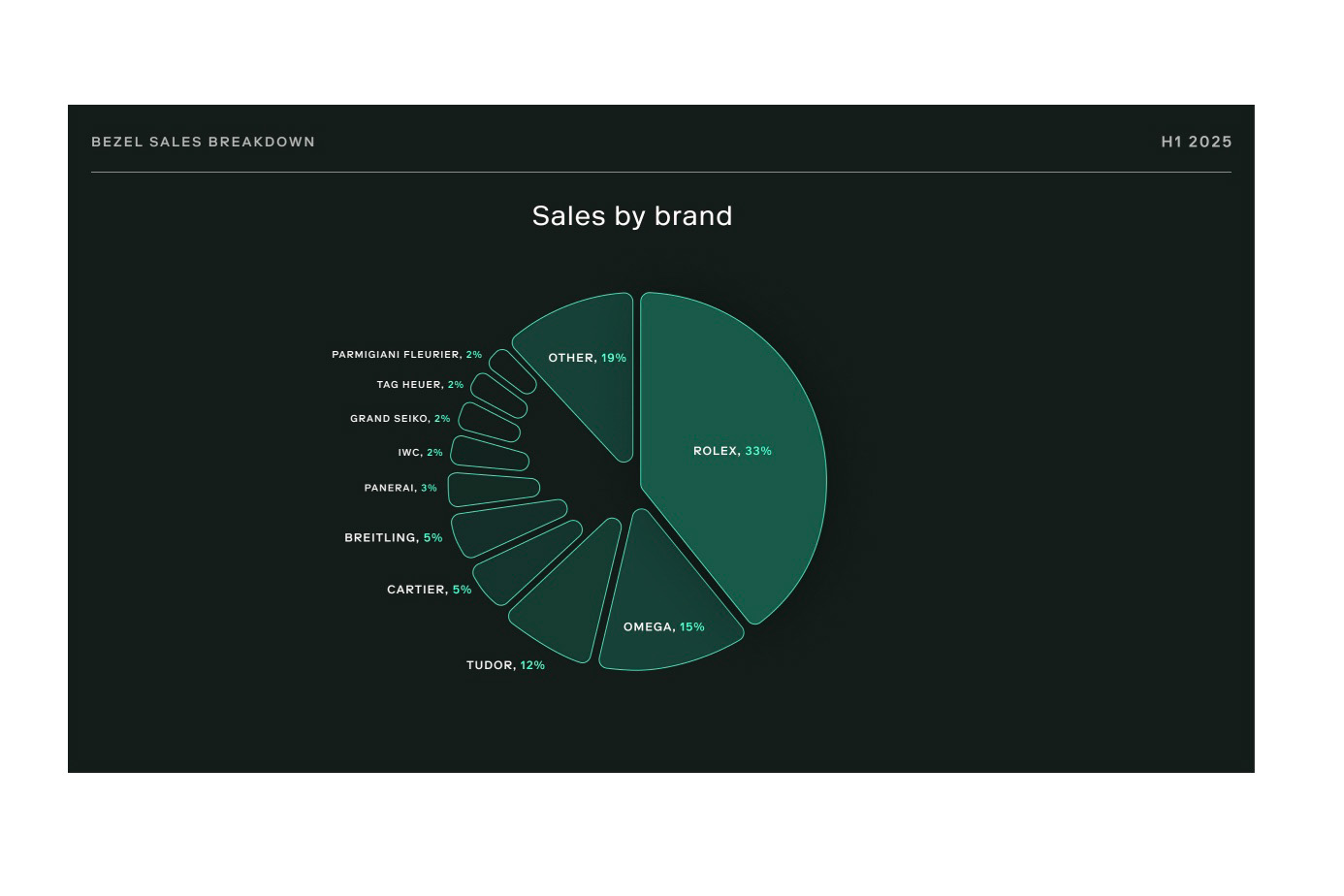

Rolex watches also topped Bezel customer "wants" lists at 37% and accounted for one-third of sales at 33% during the first six months of the year. Omega watches accounted for 15% of sales and 12% of customer wants, according to the Bezel report, while Tudor accounted for 15% of sales and 6% of customer want lists. Bezel did not disclose the number of watches or transactions used for the report, only stating that the report was based on "hundreds of millions of dollars in listings" and "thousands of purchases." In 2024, Bezel authenticators rejected 29% of transactions, according to its report, which the company said was based on $700 million worth of listings.

Top Discussions

Photo ReportFrom Centre Court To Old Bond Street: An Afternoon With Roger Federer At Rolex

In Conversation With Porsche Design's CEO: How The Brand Stays True To Its Rebellious Roots

Business NewsOnline Watch Dealer Bezel Is Rejecting More Than A Quarter Of The Watches It Inspects, Mostly Rolex