ADVERTISEMENT

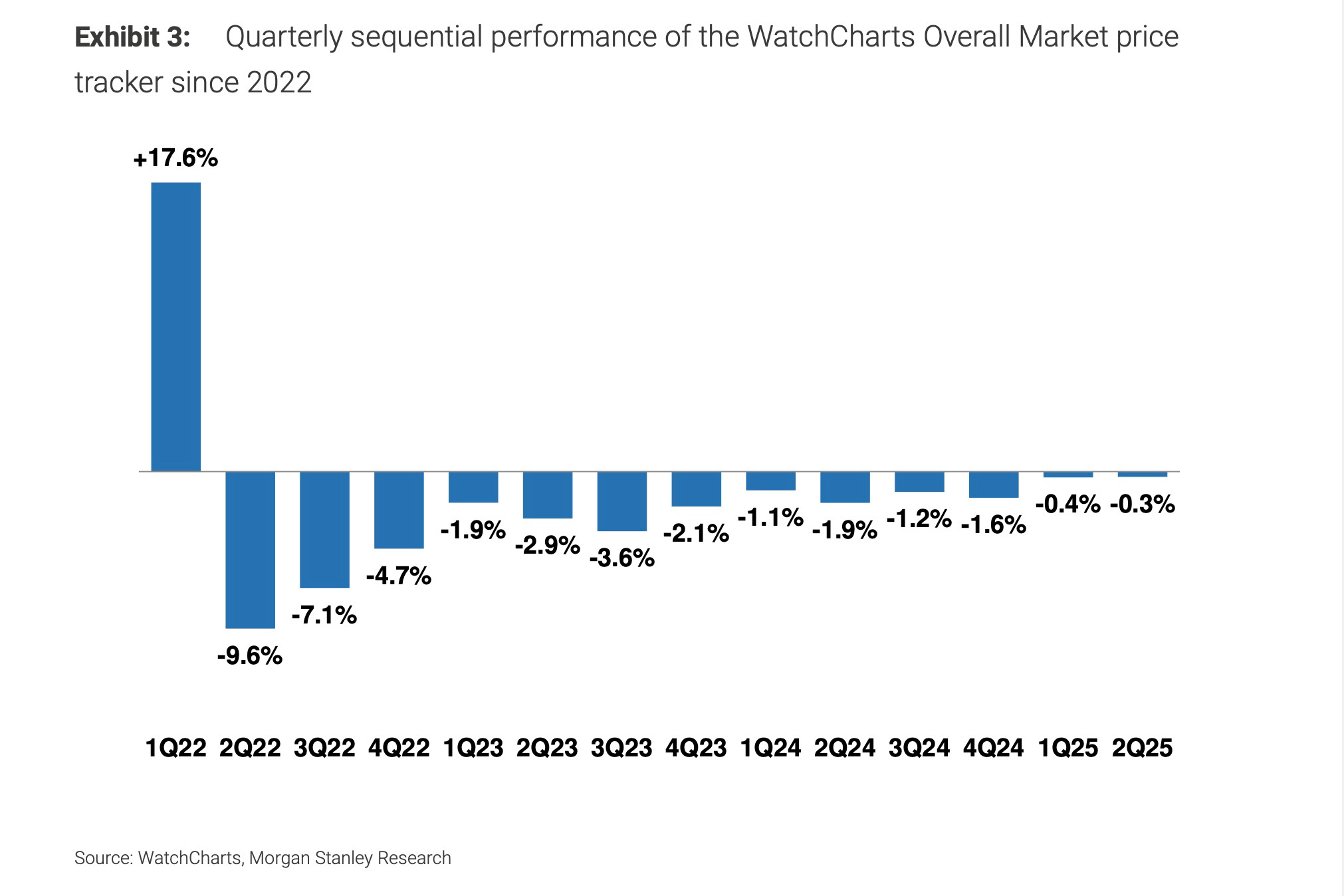

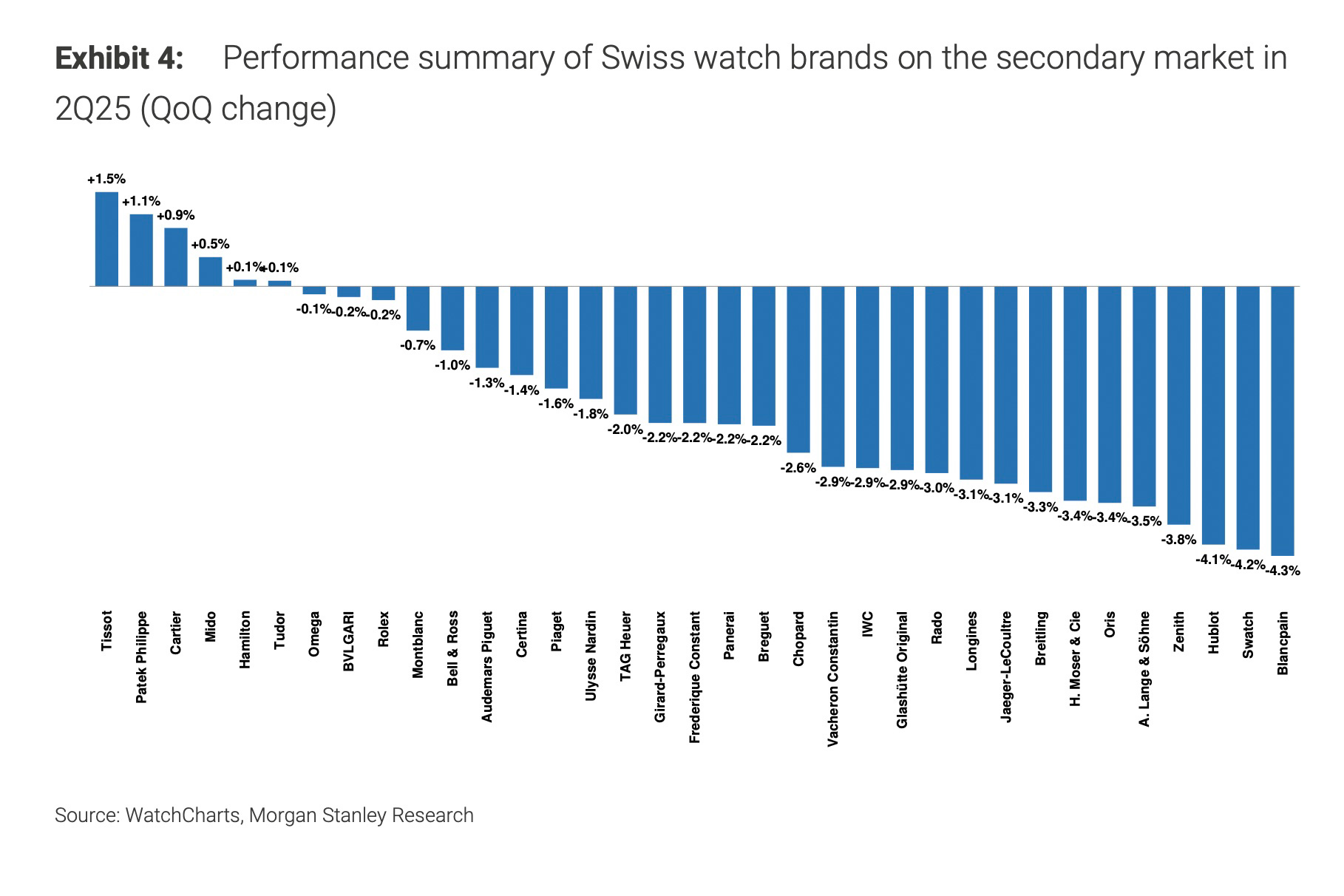

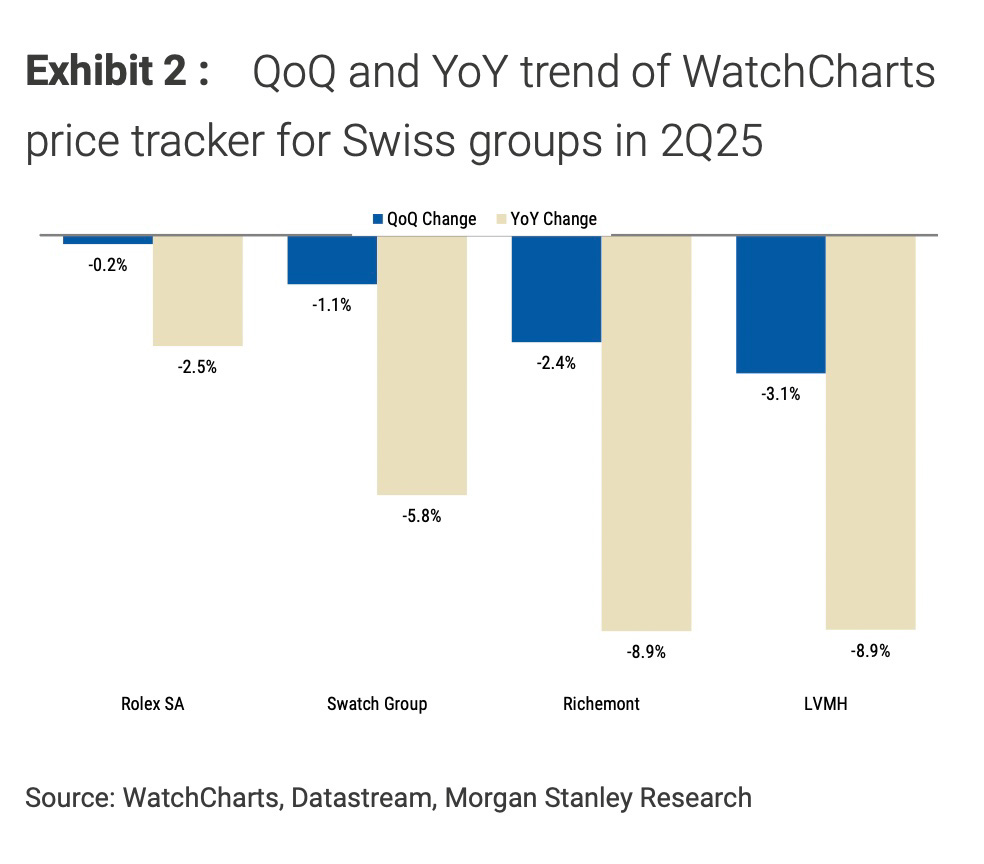

An index of prices for pre-owned Swiss luxury watches stabilized further in the second quarter, with key brands including Cartier, Omega, Rolex, and Patek Philippe outperforming the wider market and pacing declines to the slowest since the peak of early 2022, according to Morgan Stanley and WatchCharts. Average prices fell 0.3% from April to the end of June compared to the quarter before, representing a slight improvement from the 0.4% declines in the first quarter, according to the Morgan Stanley report, which uses secondary market price data and brand market indexes compiled by WatchCharts. That's the slowest rate of decline in more than three years, as buyers were willing to pay more for some pre-owned models, particularly those from these four key 'Blue Chip' brands, the report says. Supply levels for pre-owned Rolex are normalizing, and absorption rates are recovering, while demand for mid-level brands such as Cartier, Omega, and IWC is growing and has neared record highs during the second quarter, according to the report.

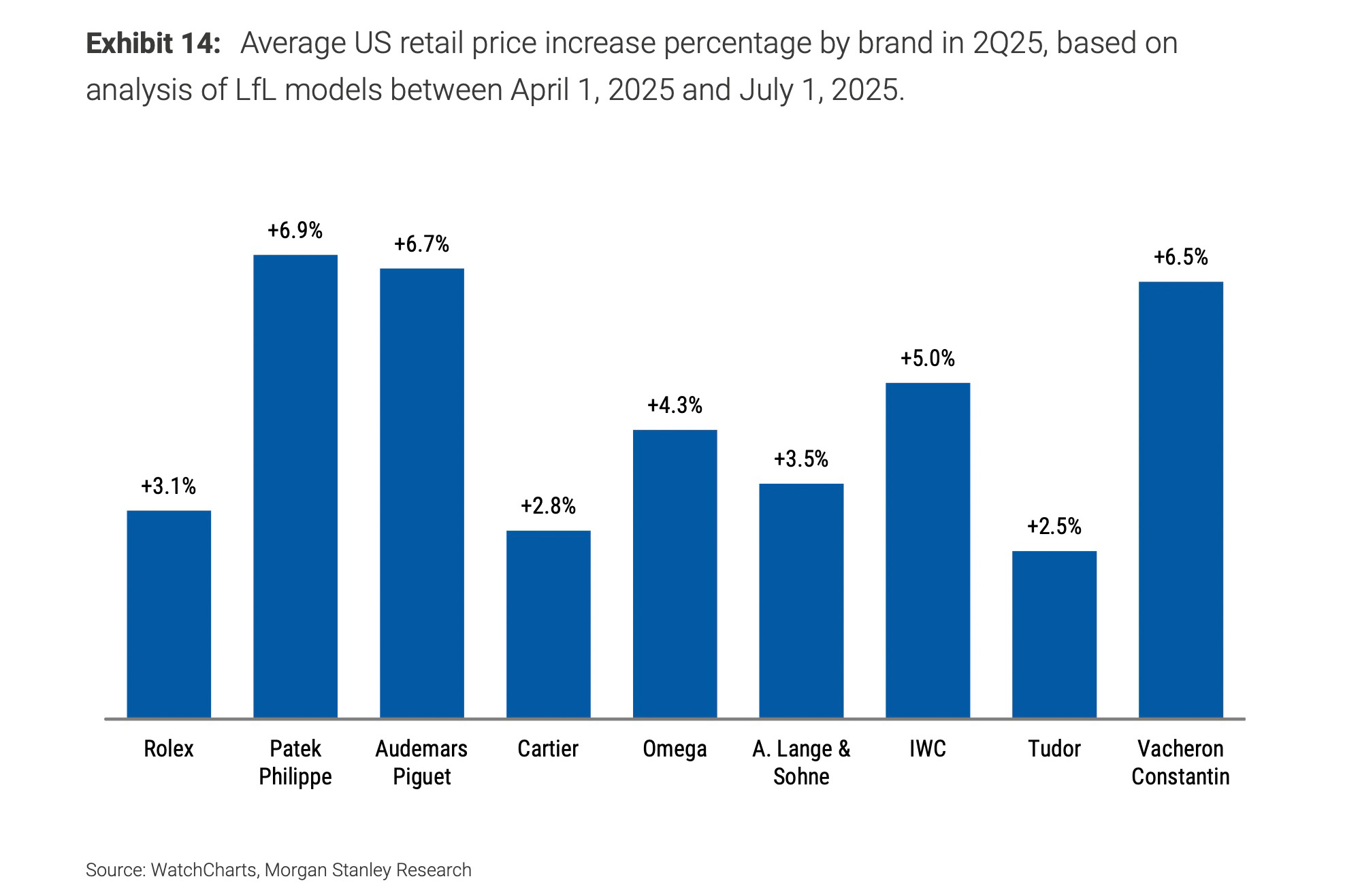

Still, prices for pre-owned Swiss watches have now declined for 13 straight quarters from the post-pandemic era peak. Of the 35 Swiss brands tracked, 29 experienced negative quarter-over-quarter performance during the period, and 25 saw an average price decline of at least 1%, according to the report. Meanwhile, value retention levels are under pressure as U.S. tariffs on Swiss, European, and Japanese imports have prompted U.S. retail price increases of between 2% and 10% from nearly all brands, according to the Morgan Stanley and WatchCharts report.

The performance of secondary market watch prices can serve as an indicator of a brand's perceived strength and equity value among consumers. The report suggests that used watch buyers are favoring 'Blue Chip' brands over lesser-known rivals. Average prices for Richemont's Cartier watches rose 0.9% during the period, driven in part by strong demand in the secondary market for models such as the Tank and Santos. Patek Philippe was another top performer, with prices rising 1.1% during the period, driven by a rebound in Nautilus model prices (up 0.5%) and continued strength in Aquanaut prices, which gained 2% quarter-over-quarter, according to WatchCharts data. Meanwhile, prices for used Rolex models, which dominate the secondary market in both volume and transaction value, remained flat or decreased slightly by 0.2%. At the same time, chief rival Omega, part of the Swatch Group, enjoyed a flat or slightly down 0.1% price change, as demand for pre-owned versions of the brand's flagship Speedmaster remained relatively strong.

Average prices for pre-owned watches made by Bulgari, the Italian jewelry brand, remained relatively stable during the second quarter, declining by 0.2%. With strong demand for models such as the Octo Finissimo and Serpenti, it was the best-performing brand controlled by LVMH in the index. Brand index prices for pre-owned watches from other LVMH brands, including Hublot, Tag Heuer, and Zenith, all declined by more than 2% during the period, with Hublot prices down the most at 4%.

With Cartier as the top performer among Richemont-owned brands, the used market prices of other marques, including A. Lange & Söhne, Vacheron Constantin, Jaeger-LeCoultre, and Panerai, all fell by more than 2%. Aside from Omega's strength, prices for Swatch Group brands, including Blancpain, Swatch, and Longines, each declined by more than 3% during the second quarter. Volume- and value-price-driven Tissot was an exception, with secondary market prices gaining 1.25% during the quarter, after the brand had been the worst performer in the first quarter of the year.

After maintaining pace with rival Patek Philippe during the first quarter, average prices for Audemars Piguet used watches declined 1.3% during Q2, as the relative strength and stability of Royal Oak models failed to offset price declines for Offshore and Code 11.59 pieces on the secondary market. AP prices are down 4.9% year over year and have underperformed Patek which fell by 2.8% and Rolex by which dropped by 2.3% over the same period. Still, the Morgan Stanley and WatchCharts report highlights that AP has seen the biggest price appreciation among the top three independent Swiss brands since January 2021.

Finally, the report showed value retention metrics (measuring a brand model's ability to retain price value compared to the current retail price) under pressure following price hikes by most brands in the U.S. in response to the 10% tariffs imposed by the White House on Swiss imports. Switzerland is among a group of countries that have yet to strike a deal to avoid further tariffs, with a new deadline now set for August 1.

Top Discussions

IntroducingThe Vacheron Constantin Overseas Perpetual Calendar Ultra-Thin, Now With Two New Dials (Live Pics)

Watch SpottingTaylor Swift Wears A Discontinued Cartier Santos Demoiselle In Her Engagement Announcement

IntroducingM.A.D.Editions x Yinka Ilori M.A.D.1S 'Grow Your Dreams' Limited Edition