ADVERTISEMENT

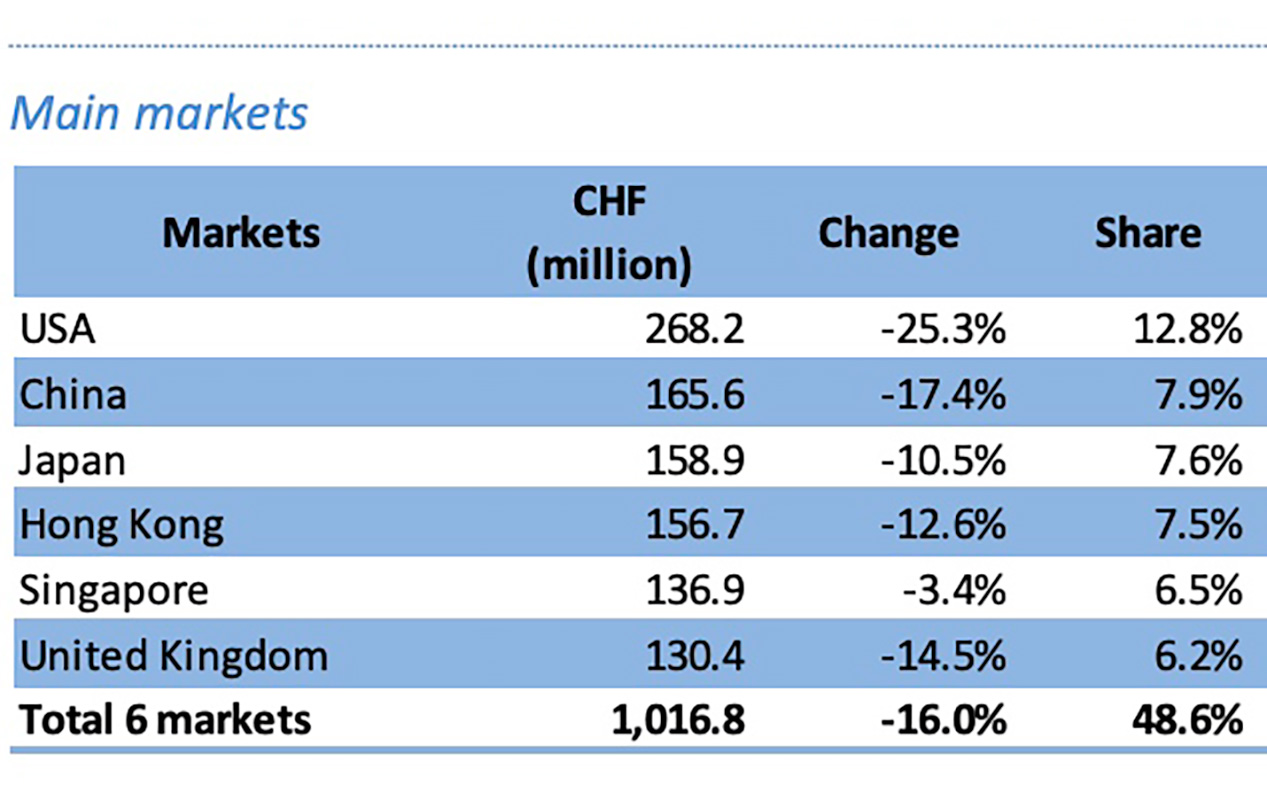

Swiss watch exports fell sharply in May after soaring the month before when retailers stocked up on expensive timepieces ahead of expected price increases in response to U.S. tariffs. Overall, wholesale exports dropped 9.5% to CHF 2.1 billion compared to the same period a year ago, following a whiplash result after April's surge, the Federation of the Swiss Watch Industry said on Thursday. Wholesale exports to the U.S., the top market for Swiss timepieces, dropped 25% last month, after skyrocketing 149% in April. Shipments to all major markets, including Japan, mainland China, Hong Kong, the United Kingdom, and France, declined.

May Swiss Watch Exports by top markets.

Source: Federation of the Swiss Watch Industry (FH).

So far in 2025, Swiss watch exports are up by a slight 1.1% compared to 2024. However, in a rare comment on actual watch sales, the Federation warns, "This result does not reflect the actual sales situation, which has followed a less positive trend." Vontobel analyst and head of Swiss equity research, Jean-Philippe Bertschy says, ''such a cautious or negative statement from the Federation is unusual and noteworthy.'' In a note to clients, Bertschy says that the May export data reflects the first signs of a slowdown this year. And while the May U.S. Swiss watch import decline was due largely to an expected surge in April in response to tariffs, "the downward trend in other markets is a growing concern,'' he says

The downward trend in other markets is a growing concern.''

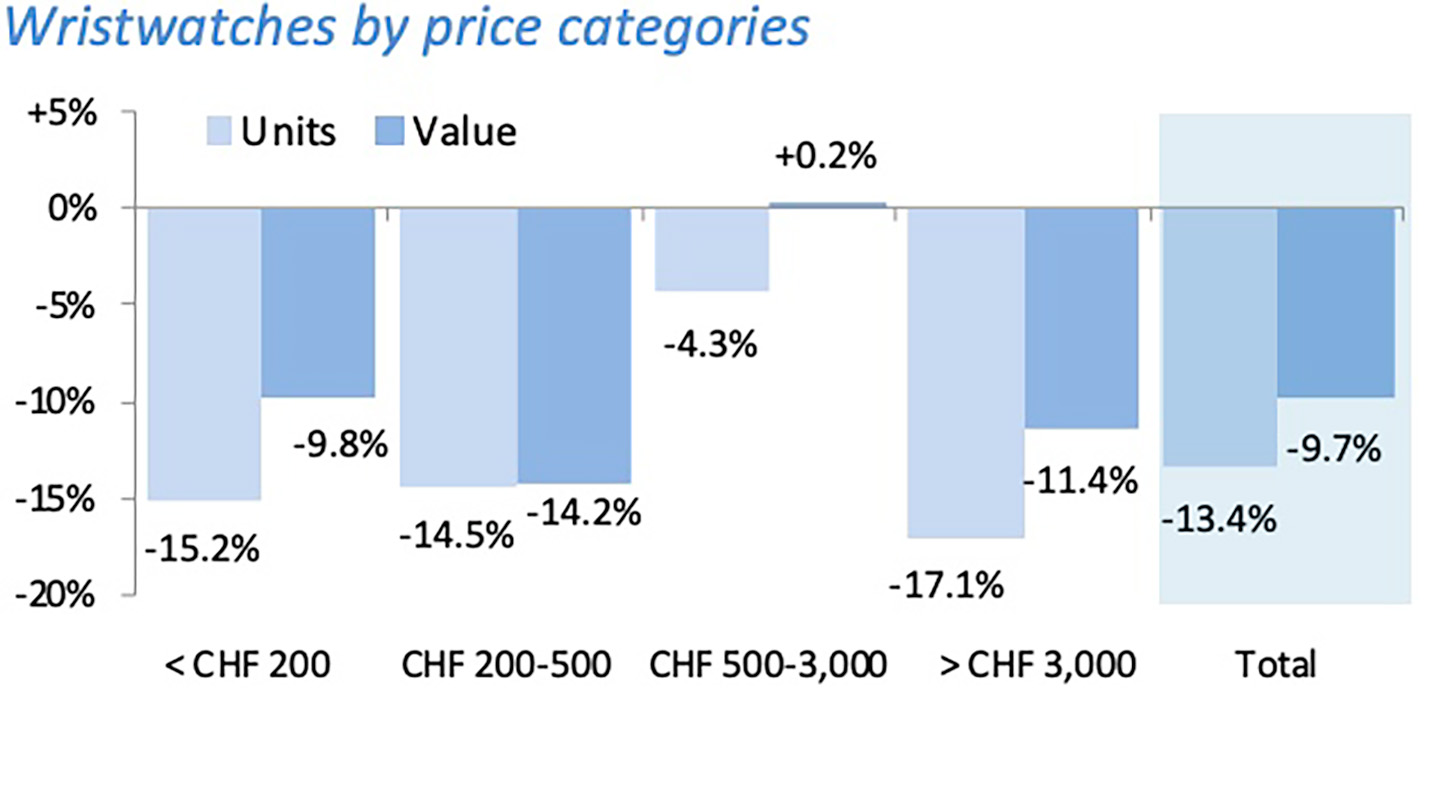

– Jean-Philippe bertschy, managing director and head of swiss equity research, vontobelWith China still mired in an economic slowdown due to a real estate crisis, the gains in year-to-date Swiss watch exports have been driven almost entirely by the U.S., which accounted for 21% of total exports, a record high. The May export data showed declines in nearly all price categories, including watches with wholesale prices above 3,000 francs, which have been a key driver of value gains as brands continue the trend of producing fewer, but more expensive, timepieces.

May Swiss watch exports by price category.

Source: Federation of the Swiss Watch Industry.

In a so-called "Liberation Day'' address in April, U.S. President Donald Trump threatened 31% tariffs on Swiss imports, including watches, before reducing the levy to 10% as the two nations seek a bilateral agreement. While U.S. officials have said Switzerland has moved to the front of the line for a deal, an accord has yet to be reached.

Brands including Rolex, Tudor, Omega, and Audemars Piguet have raised U.S. prices in response to the tariffs. The radical shifts in U.S. trade policy have created "uncertainty'' for many watch consumers, according to some top brand CEOs. U.S. Federal Reserve Chair Jerome Powell used the words "uncertain" or "uncertainty" more than 15 times on Wednesday in a press conference after the Fed left interest rates unchanged and lowered its outlook for U.S. GDP growth to 1.4% from 1.7%.

Top Discussions

IntroducingThe Omega Aqua Terra 150M Turquoise On Strap

HappeningsAstronaut Charles "Pete" Conrad, Jr.'s Speedmaster On Display At Kennedy Space Center

IntroducingThe New Tudor Royal 28mm: In Blue And With Diamonds