ADVERTISEMENT

In the past five years, we've been on a rollercoaster in both the primary and secondary markets. Inventory, pricing, demand, and availability have all been in flux, reaching highs and lows as they attempt to stabilize at a new normal.

The pandemic created lasting shifts on both sides of the coin, from how the industry produces and allocates to how consumers buy (and sell) within their collections. This was a bit jarring to say the least, but this is nothing new, confirms Nate Borgelt, the head of the watch department at Bonhams. "With any type of investment, there will always be volatility – the oil market, the stock market – watches are no different. Look back at the 2008 financial crisis and the bankruptcy of Lehman Brothers – we saw an impact at auctions and in the industry at large. There are always going to be external factors that impact the value of watches," Borgelt asserts.

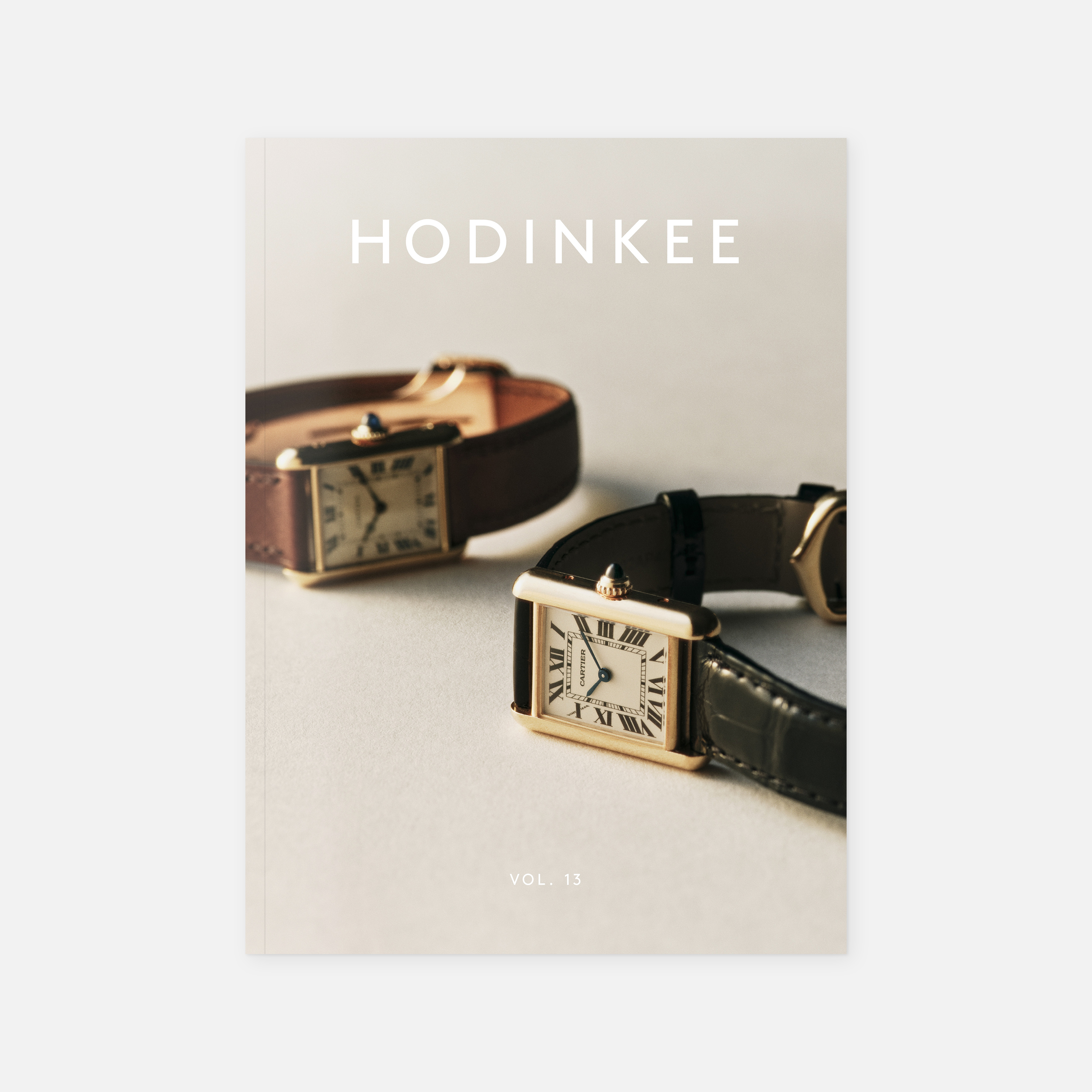

Knowing these fluctuations will forever be part of the collecting journey, it's vital to recognize the shifting value of your collection as well as how to protect it. For the latter, this is where Hodinkee Insurance comes into play. Thanks to our underwriting partner, Chubb – one of the world leaders in property and valuables insurance – we offer coverage tailor-made for watch collectors and jewelry lovers. But first, let's take a step back to better understand the starting point of making sure your collection is properly covered: valuation.

Retail Replacement Value vs. Fair Market Value

There are essentially two levels of the market: retail replacement value and fair market value. "When it comes to insurance, replacement value – or the highest price you'd have to pay to replace a loss with something of similar quality and type – is the thing to know," clarifies Elizabeth Von Habsburg, Managing Director of Winston Art Group (WAG), a leading independent appraisal and advisory firm in the U.S. However, here's where some of the external factors begin to complicate things.

According to Von Habsburg's colleague, Senior Jewelry Specialist and WAG's Director of New England, Kendall Reed, it's essential to have a holistic view when it comes to defining replacement value. "We think of it as not just retail, but the primary market for the object. This is where our network comes in: we examine dealers, major retailers, the auction market, and peer-to-peer private sales. In my opinion, having an appraiser with this holistic view of the marketplace and who understands the different approaches to value is important."

We all know that today, high-demand models (such as the Nautilus, Daytona, or jewelry signed with names like Cartier and Bulgari) often require years of dedication and substantial purchasing power to acquire at retail. Because of this scarcity, the values of these models are often higher in the secondary market. "When we're appraising watches, we always look at the secondary market as a leader," agrees Doug Escribano, Senior International Specialist at Phillips Watches. "So often, I have to explain to insurance brokers that the secondary market is key in defining replacement value over retail because collectors can so seldom return to a retailer for a replacement with the years-long waitlists that have become commonplace."

So, say you just finally got that model you've been dreaming of from such a waitlist. It's best to have the item appraised soon after purchase and to document important details, such as your case and movement numbers. "I always emphasize the importance of noting details like case number with this example," explains Escribano. "A woman had inherited her father's Rolex Daytona 6265. She never got it insured, and it was ultimately stolen. However, she did have the case number. So, she filed a report with the police and with Rolex. Five years later, she got a call from Rolex, and it was on a dealer's website – she ended up getting the watch back."

After obtaining your initial appraisal and updating your insurance policy accordingly, it doesn't end there. "We recommend itemizing your watch and jewelry collections, sharing any significant updates with key family members, and getting your items re-appraised every one to three years," states Reginald Brack, SVP of the watch department at Freeman's Hindman.

At a specialized appraisal firm like WAG, clients receive added peace of mind beyond standard reappraisal practices, which occur every few years. "If we see something significant happening in one area of the market, we'll contact every client who has something relevant and suggest a reappraisal," explains Von Habsburg.

Protecting Collection Value with Hodinkee Insurance

While we support the expert advice to have your watches and jewelry re-appraised every one to three years, a key part of the convenience with Hodinkee Insurance is that we typically don't require appraisals for watches or jewelry valued under $100,000. You simply decide the value, and we take care of the rest. This way, as markets fluctuate and the value of pieces change, you're in control of the covered value you need for your collection.

In addition to the ability to adjust your own covered value, Hodinkee Insurance policies are also backed by appreciation protection. Appreciation protection serves to protect against market price inflation that exceeds the insured value of your collection at the time of a covered loss. It's a collector-focused benefit of Hodinkee Insurance, aimed at providing peace of mind in a scenario where the insured value of your collection has not been adjusted prior to a loss.

For example, if the market value of a watch or piece of jewelry insured under your policy increases before a loss, Chubb will pay the market value before the loss, up to 150 percent of your watch or jewelry's insured value, up to the policy limit. In other words, payment will never exceed the total coverage amount for your collection. For example, if you have three watches on your policy, each valued at $10,000, and the value of one watch at the time of a covered loss had increased to $13,000, you would still be below the policy limit (of $30,000).

Have additional questions about valuations, appraisals, or your collection? We're here to help, just send us an email at [email protected]. If you're ready to start a policy, you can get a quote for your collection in just a few minutes. Click here to learn more.