ADVERTISEMENT

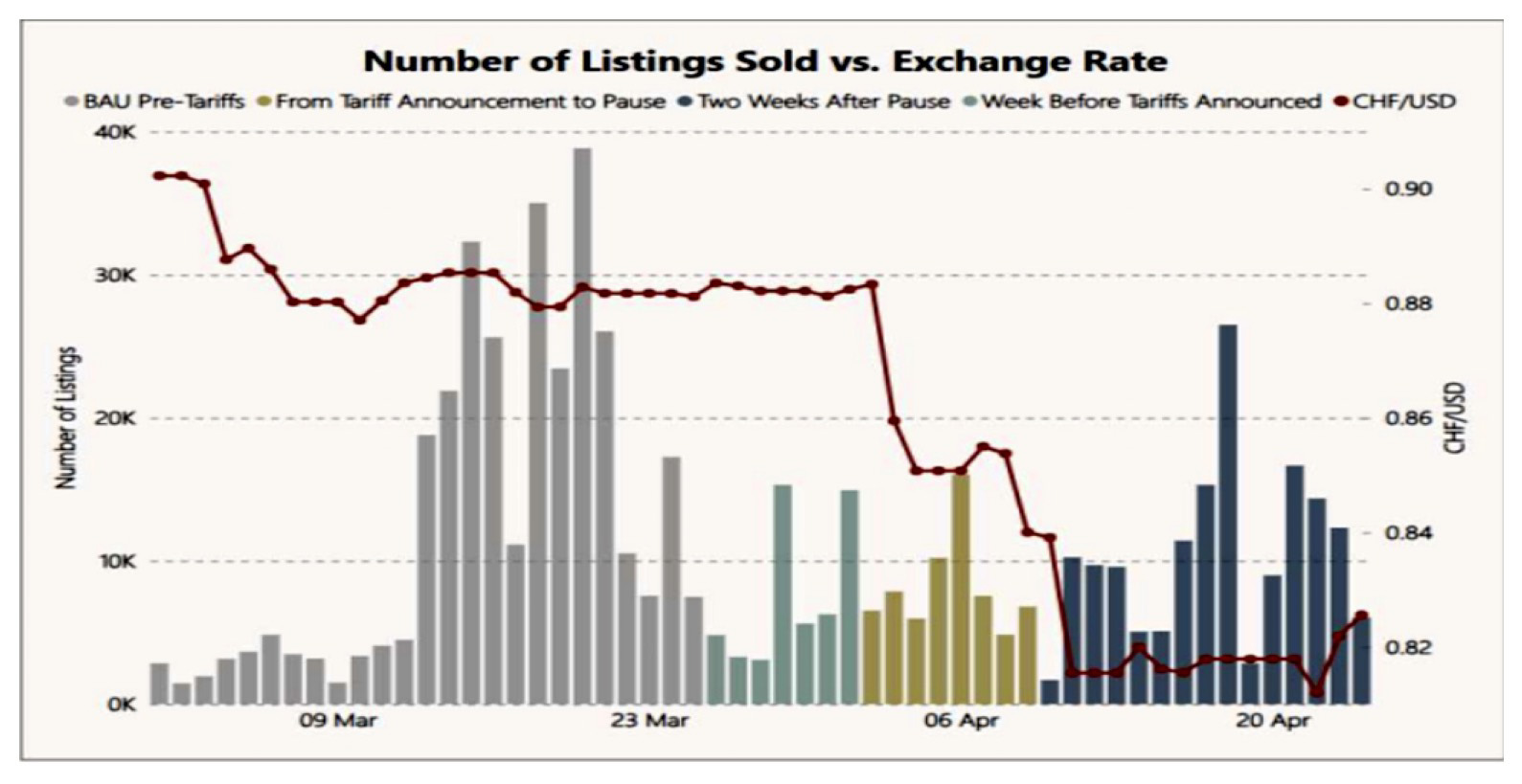

Shockingly high tariff rates on Swiss goods imported to the U.S. announced by the White House are threatening to upend the Swiss watch industry and crimp sales in the biggest market for luxury timepieces. U.S. President Donald Trump said this week he would impose a 39% tariff on Swiss goods, including watches, after the U.S. and Switzerland failed to reach a trade agreement ahead of an August 1st deadline.

That's nearly three times higher than any other European country and among the highest globally—exceeding even the 31% rate Trump initially threatened against Switzerland in his April "Liberation Day" speech that disrupted Watches and Wonders, the horological industry's premier trade show. It's also higher than the 15% agreed to by other major watchmaking countries such as Germany in the European Union and Japan, which struck trade agreements with their American counterparts. Swiss watchmakers, from industry giants Rolex and Audemars Piguet to conglomerate-owned brands such as Omega or Vacheron Constantin, and down to smaller independents including Oris and Raymond Weil, are facing massive increases in levies and import costs to their biggest market ahead of the implementation date of the new tariffs on August 7. Swiss industry leaders and politicians called on the Swiss Federal Council and trade negotiators to strike a deal before the weighty border levies come into effect.

"The U.S. is our biggest market these days. It would be brutal. That is clear," Rolf Studer, the co-CEO of Oris, says in an interview. The Swiss executive says implementing tariffs at this level would not only threaten jobs among the approximately 60,000 workers employed in Switzerland in the industry, but also the thousands of Americans who work in watch retail, marketing, and communications in the U.S.

"A 10% tariff we could handle, but 39% is prohibitive. It means you are locking large parts of the Swiss industry out of the U.S," he says. "I hope that the last word hasn't been spoken and that a solution is found.''

Swiss President Karin Keller-Sutter spoke with President Trump on Thursday ahead of the tariff deadline, noting the trade deficit between the two countries "remains a central concern" for Trump, she said in a post on X that confirmed no agreement had been reached based on a statement of intent negotiated between the two nations. The president says Swiss officials remain in touch with their U.S. counterparts and are trying to work out a last-minute deal. The U.S. trade deficit with Switzerland is about $38.5 billion, according to U.S. trade representatives, with Switzerland exporting products including watches, pharmaceuticals, and industrial products to the U.S.

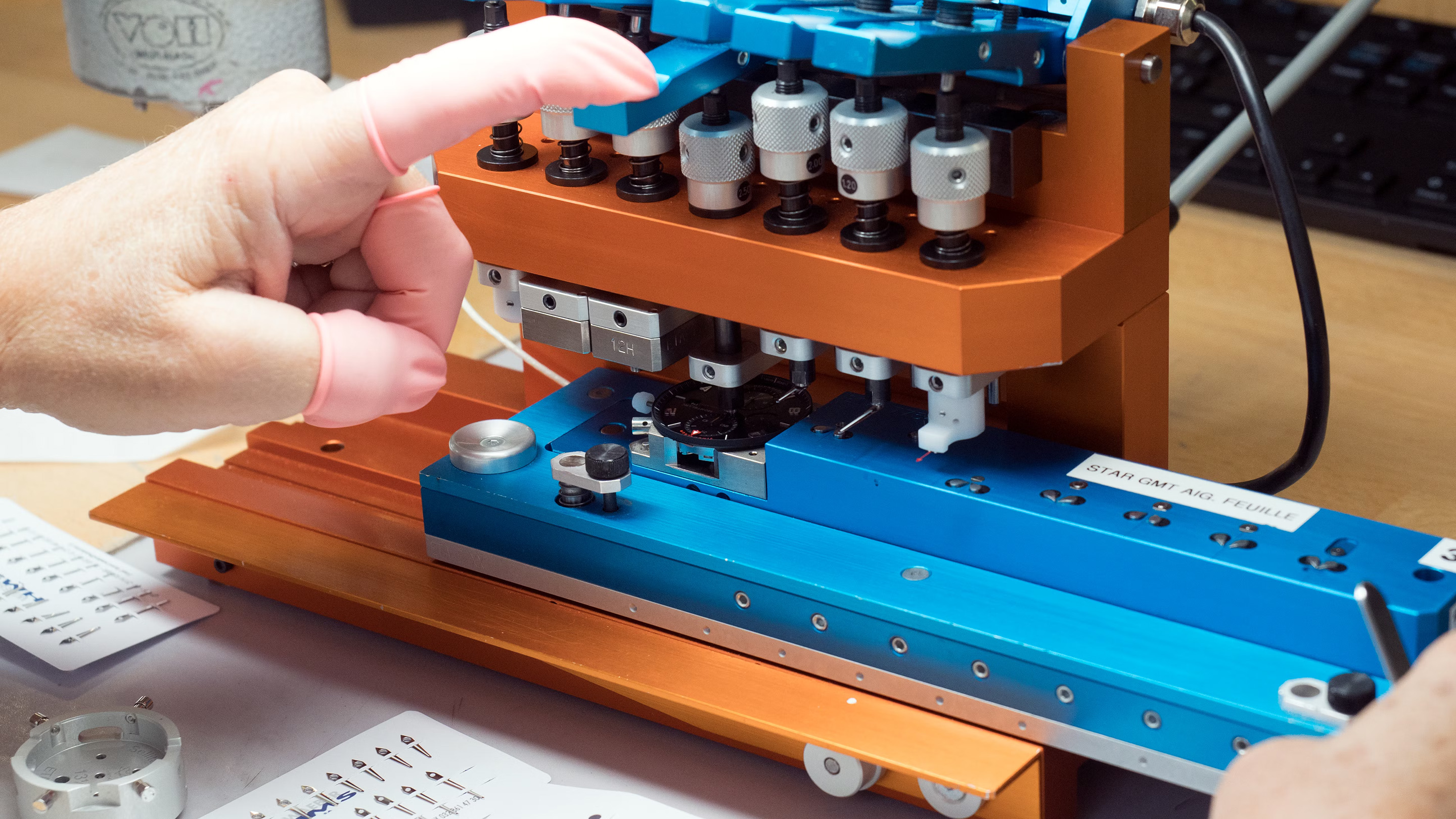

However, when accounting for U.S. services imported to Switzerland, such as financial and technology services from U.S. companies like Apple, Google, and Microsoft, the deficit is much smaller. The trade deficit also includes gold, which is typically imported and refined in Switzerland before being exported elsewhere. Swiss business leaders have called the so-called 'reciprocal' tariff levels "dangerous" and "completely irrational and arbitrary." There is, of course, no industrial watchmaking capacity in the U.S., and there hasn't been since the 1960s. It would take years, if not decades, and billions of dollars in investment to build up any significant watchmaking industry capacity in the United States. Studer says Oris could theoretically try to produce watches in the U.S., but they would, of course, no longer be Swiss watches.

Some Swiss watch brands and companies, including Rolex, Richemont, and Swatch Group, have already raised prices in the U.S. in response to the 10% tariffs on Swiss imports that are currently in place. They and other brands could raise prices further to counter even higher levies. Analysts at UBS, estimate that a 39% tariff would imply a mid-single-digit negative percentage impact for Richemont's pre-tax earnings and a near 40% drop for Swatch Group. Analysts at Barclays say brands are expected to raise prices to offset the tariff, but not by the full 39% and that "supply-constrained brands'' such as Rolex and Patek Philippe, can likely raise prices with minimal impact on volumes while "non-supply-constrained brands'' may struggle to raise prices without losing volume, ''especially in a softer macro environment," they say.

Representatives of Rolex, the biggest Swiss watchmaker by sales, as well as Swatch Group, whose brands include Tissot and Omega, declined to comment. A representative of Richemont, whose brands include Swiss made Cartier watches, Vacheron Constantin and IWC, also did not respond to a request for comment on August 1, which is a national holiday in Switzerland. The lack of a deal and the high tariff level is a surprise and follows positive comments made by U.S. trade representatives in May when U.S. Treasury Secretary Scott Bessent said Switzerland had climbed to the front of the queue for trade deals after helping facilitate U.S. trade talks with China in Geneva.

U.S. Trade Representative Jamieson Greer. (left), and U.S. Treasury Secretary Scott Bessent (right) in Geneva on May 12.

If the 39% tariffs are implemented, watch consumers and dealers are expected to change how they buy watches and do business in the U.S. "As an American collector, I certainly won't be taking delivery of any of my orders for 2025 until something gives,'' says Eric Ku, a collector and head of U.S.-based online watch auctioneer Loupe This.

''As a business, Loupe This will either completely stop our taking of consignments from the rest of the world [outside the U.S.] or make us accelerate our plans to open a fully functional office in Hong Kong to run auctions from,'' Ku adds.

Tudor, which is part of the Rolex group, raised prices by about 3% in response to tariffs.

The hefty tariffs could also give strength to the secondary watch market in the U.S., with a potentially higher premium placed on pre-owned Swiss watches already in the country. "This tariff effectively creates two separate Swiss watch markets - one for Americans paying premium prices, and one for everyone else getting (relative) bargains,'' says Kingflum, the pen name for the creator and author of the ScrewDownCrown watch blog on Substack.

"That will accelerate the geographic fragmentation of luxury watch trading and make pre-tariff inventory already in the US, essentially, a new asset class,'' he says.

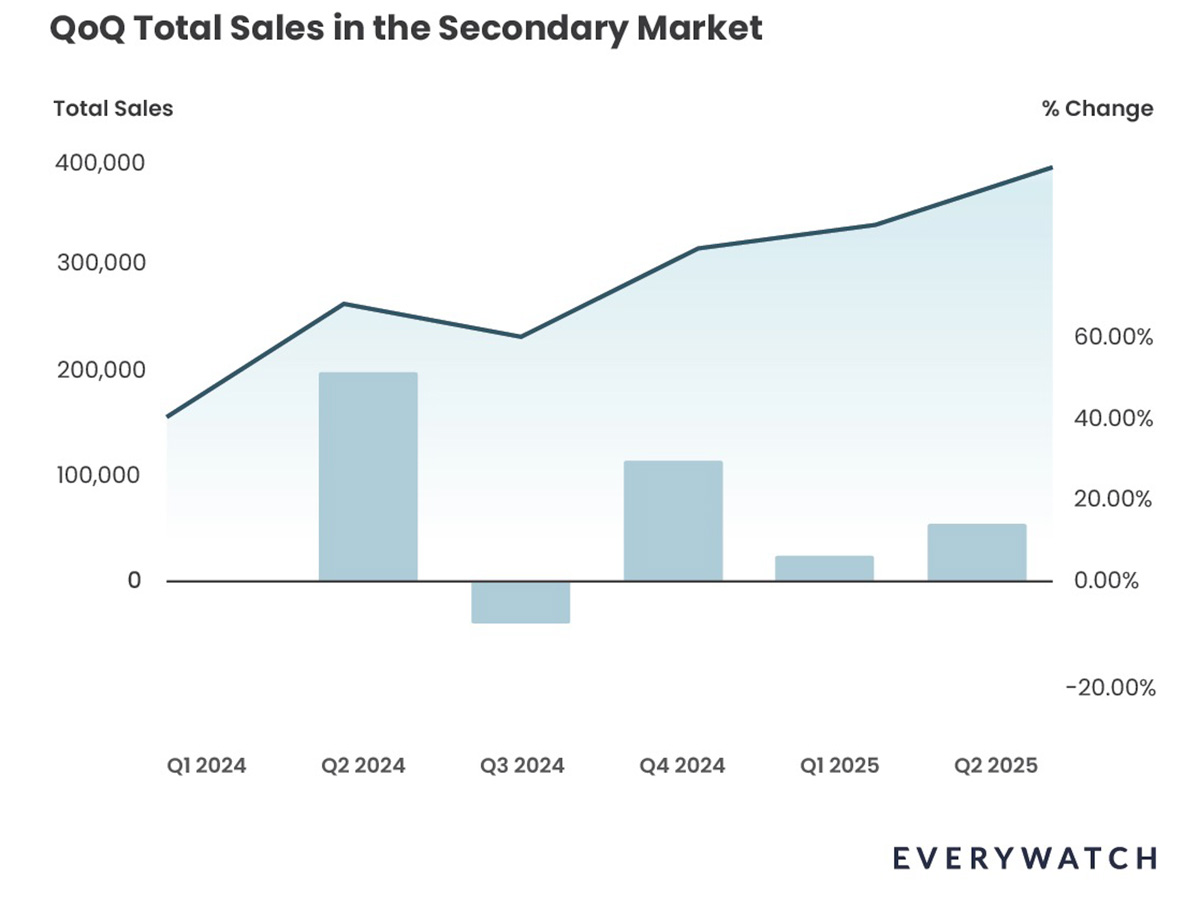

EveryWatch, a Europe-based firm that monitors, collects, and analyzes data on the secondary watch market, says used watch sales have grown by more than 30% in both value and volume during the first half of the year.

"The U.S. market, after an April slowdown tied to tariff announcements, has since rebounded powerfully, leading global momentum in June and July. With the new 39% tariff, the primary market will face pressure while the secondary, especially the vintage segment, will gain further strength,'' says Giovanni Prigigallo, co-founder and head of business development at EveryWatch. "Certified pre-owned programs such as Rolex CPO stand to expand rapidly, and if tariffs persist, the secondary market may overtake the primary sooner than expected. Ultimately, brand responses on pricing versus margin absorption will be decisive,'' he adds.

The U.S. is the biggest single-nation market for Swiss watches and has been a key driver of growth as the economies of traditionally strong markets, including mainland China and Hong Kong, slow. Swiss watchmakers have also been struggling with a strong Swiss franc against a weaker U.S. dollar and soaring input costs as some materials, such as the price of gold, have surged to record levels. Swiss watch exports to the US rose 5% by value in 2024, while shipments to China fell 25% in a year that saw overall wholesale exports decline 2.8% to about CHF 26 billion.

The U.S. accounted for about 17% of total Swiss watch exports in 2024, but for some brands, that percentage is much higher. The proposed 39% tax will be on the import value of a watch, which could mean an increase of about 12% to 14% on the final selling price to the consumer, if a brand were to pass on all the costs to customers, says Oliver Mueller, the head of LuxeConsult in Switzerland and a contributor to Morgan Stanley's annual report on the watch industry. That means that a Tissot PRX could cost almost $100 more as its price would increase from $775 to $870, while a Rolex Submariner should see its price increase from about $9,500 to $10,600, an increase of $1,100, if buyers had to bear the entire cost of the tariffs, Mueller says.

Stay tuned for continued reporting as we approach the August 7 implementation date, when Switzerland will face the 39% tariff without a successful trade agreement in place.

Top Discussions

Business NewsSwiss Watch Industry Fears Impact From 39% U.S. Tariff With Hopes For Last-Minute Deal

Bring a LoupeA Movado With Breguet Numerals, A Water-Resistant Patek Calatrava, And A Rolex Zephyr

IntroducingThe New Seiko Prospex Alpinist SPB531, A New Blue European Exclusive