ADVERTISEMENT

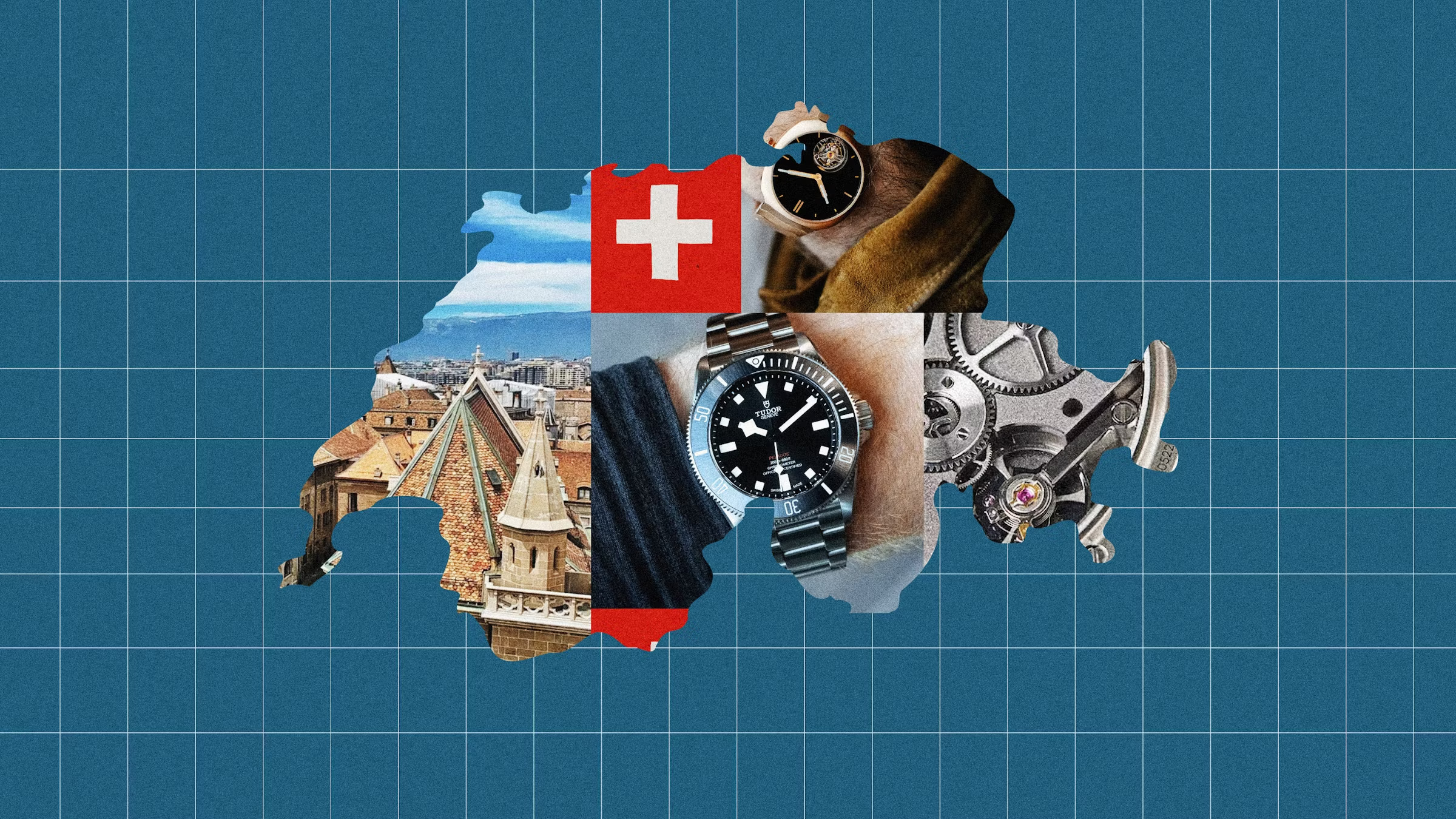

Swiss watch exports to the U.S. spiked again last month as brands and retailers moved to stock up in the key market ahead of tariffs slapped on imported goods from Switzerland. Exports of watches and movements to the U.S. jumped 45% to CHF 555 million by value in July compared to a year ago, the Federation of the Swiss Watch Industry said in a statement. The unusual surge in exports to the biggest single market for Swiss watches continues a volatile pattern created by surprise import levies imposed by the Trump administration on its biggest trading partners that has prompted a 24% gain in Swiss watch exports to the U.S. in 2025. While other key watch-making regions and nations, including the European Union and Japan, were hit with 15% tariffs, the White House imposed a 39% tariff on Swiss goods on August 1, excluding gold and pharmaceuticals, after efforts by Swiss politicians and business leaders failed to win a better deal. That's the highest tariff level the U.S. has initiated on an industrialized country, as the 39% levy came into effect on August 7.

Vontobel analyst Jean-Philippe Bertschy says the U.S. tariff situation is skewing monthly export data for the Swiss industry that is suffering from "luxury fatigue" and continued weakness in China, once the biggest single market for Swiss timepieces. "From January through July, nine of the ten largest markets recorded negative growth; only the U.S. is positive, underscoring the headwinds facing Swiss watchmakers,'' Bertschy says.

The data confirms comments reported by Hodinkee from Breitling's top executive and other industry players, indicating that brands shipped stock to U.S. retail partners ahead of the tariff deadline. Breitling said it has about 3 months' worth of inventory in the U.S. and that if a deal to reduce tariffs imposed on Swiss goods isn't reached, it will likely have to raise prices to offset higher costs. Brands including Rolex, Tudor, Omega, Blancpain, and Audemars Piguet raised prices in the U.S. in the spring between 3% and 10% following the initial tariff announcement. They're all hoping a better deal can be won for Switzerland to avoid further industry pain.

Audemars Piguet Buys Majority Stake In Key Supplier Inhotec

Audemars Piguet, the storied Swiss brand that is among the five largest by sales, bought a majority stake in Inhotec SA, a key Swiss supplier involved in high-precision machining and micromechanics. Founded in 2011 in Le Locle by Alexandre Eme, the company specializes in supplying components and finishing for haute horology clients. Financial terms and reasons for the investment weren't disclosed, but it comes as suppliers to the Swiss watch industry have been under pressure amid a downturn in production following the post-pandemic era boom, when demand surged to unprecedented levels.

Audemars Piguet says it will provide financial and strategic support to Inhotec, allowing it to continue operating independently and supply other watchmakers. The investment builds on the longstanding relationship between the two companies and reflects a shared long-term industrial vision "while strengthening Inhotec's position within the Swiss watchmaking industrial ecosystem," Audemars Piguet says in a statement.

Inhotec founder and CEO Alexandre Eme will retain a "significant" minority stake in the company and continue to lead the firm and chair its board of directors. "By joining forces, we are creating the conditions for Inhotec to continue innovating and serving the entire watchmaking industry,'' Eme says in a statement.

The investment "ensures the future of a precision expertise that contributes to the excellence of Swiss Haute Horology,'' Lucas Raggi, Chief Industrial Officer of Audemars Piguet says.

Casio Names New U.S. President and CEO

Yusuke Suzuki, President and CEO of Casio Americas

In a move the company says underscores its commitment to accelerating growth in the U.S. market, Casio Americas Inc. named veteran executive Yusuke Suzuki as its new president and CEO. Suzuki succeeds Tomoo Kato, who served in the role for three years.

A three-decade career at Casio has seen Suzuki take on executive roles in Japan, Europe, and most recently as head of the U.K. at the G-Shock brand. "The U.S. remains a cornerstone of Casio's global growth strategy, and I'm committed to building on our momentum—investing in breakthrough product innovation, customer experience, and brand strength," Suzuki says in a statement.

Top Discussions

IntroducingThe Doxa Sub 200 'Dune'

Hands-OnPaulin Dives Into Tool Watch Design With The Mara

Bring a LoupeBuy This, Not That: Vintage Movado